Arkansas offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Arkansas Energy Efficiency

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Arkansas Government

Executive Office

500 Woodlane Avenue, Suite 256

Little Rock, AR 72201

(501) 682-1010

Hours: M-F 8:00am – 4:30pm

Entergy Arkansas

425 W Capitol Ave

Little Rock, AR, 72201

(800) 368-3749

Hours: M-F 8:00am – 5:00pm

Arkansas Energy Office

Arkansas Department of Energy and Environment

Division of Environmental Quality

5301 Northshore Drive

North Little Rock, AR 72118-5317

Phone: (501) 682-0744

Toll-Free: (888) 233-0326

Fax: (501) 682-0880

[email protected]

Hours: M-F 8:00am – 4:30pm

Little Rock Weather Bureau

8400 Remount Road

North Little Rock, AR 72118

(501) 834-0308

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

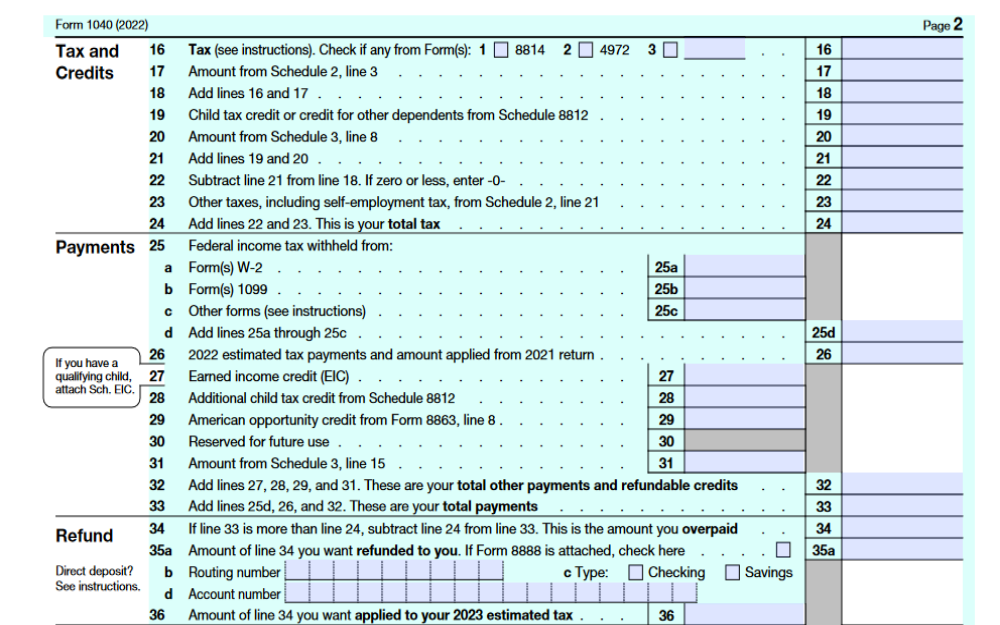

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Arkansas Clean Energy

Power Company Rebates

Distributed Energy Resources

Net Metering

Clean Cities

Electric Vehicle Funding

Service Territory

State Legislature

Power Outage Map

Department of Energy and Environment

Division of Environmental Quality

5301 Northshore Drive

North Little Rock, AR 72118-5317

Office Hours:

8:00am-4:30pm

Phone: (501) 682-0744

Toll-Free: (888) 233-0326

Fax: (501) 682-0880

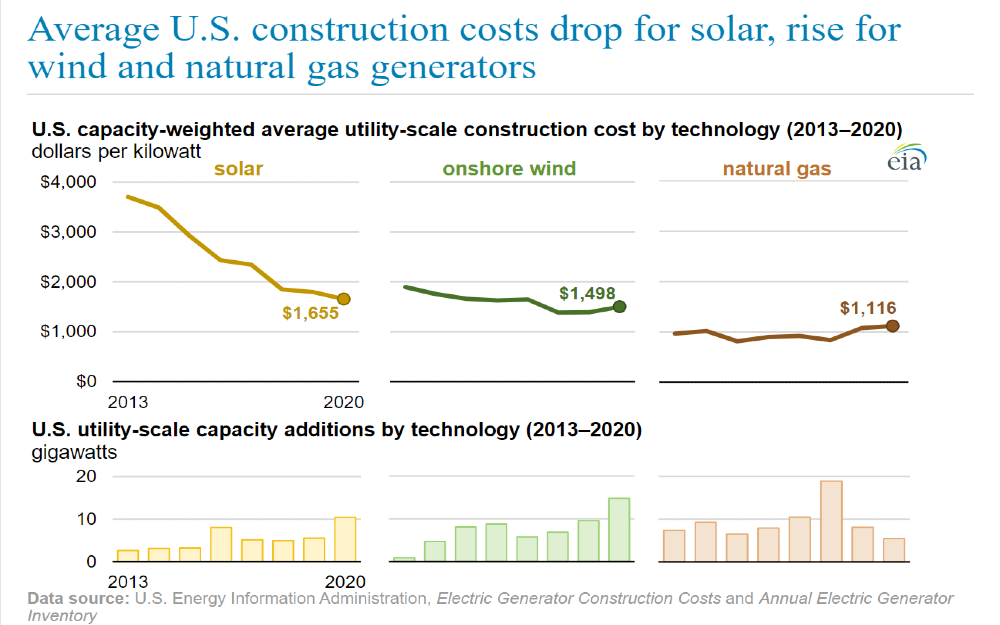

Due to an increase in electricity costs combined with a decrease in solar panel prices, there are many reasons to take advantage of open enrollment in the solar credit programs available in the state.

This guide provides an overview of the rebates, tax credits, and other programs Arkansas residents can employ to significantly reduce the cost of a home solar installation.

What Arkansas Tax Programs for Solar Energy Are Available?

Arkansas solar incentives have truly been the breakthrough that the region needs to finally start rising up the ranks as a notable solar state.

The state currently ranks number 32 in solar implementation, a factor that is slowly changing.

The largest incentive is offered by the federal government.

Federal Tax Credit for Solar Photovoltaics

In a bid to increase the adoption rate of solar power, the federal Solar Investment Tax Credit was created in the year 2005. This saw to it that first-time solar owners could have 30% of their installation cost slashed through a tax credit or tax relief.

The name of the credit has changed to the Federal Tax Credit for Solar Photovoltaics (basically, solar photovoltaic panels are part of the system that is eligible for tax credit).

So, basically, whatever you spend on your panels, take 30% of that, and that will be the total amount that will be deducted from your taxes or the amount of tax liability that you have.

For instance, if you have to spend an average of $27,900, then what that implies is that you will be able to slash more than $8,000 off the total costs.4

Joining the list of Arkansas solar credits apart from the ITC are Energy Efficiency and Renewable Energy (EERE) programs initiatives, there are local incentives in the region that are available for specific utility company customers in particular regions.2

Although most may not exactly be as lucrative as the solar tax credit, each of the following Arkansas solar panel programs below is an effective way to help reduce the cost of your installation.

NAECI Program

If you are a loyal customer of the North Arkansas Electric Cooperative, you are lucky because you will be able to apply and actually get loan funding for your energy-efficient projects.

The company ensures that the rates are way more affordable at a 1.5% interest rate, and the amount can go as high as $20,000.

To apply for this funding, simply fill out the online form located on the co-op’s website.14

AOG Program

Arkansas Oklahoma Gas (AOG) customers also have the advantage of being eligible for the $100-$5,000 rebates if you install energy efficient equipment.

The forms are available online,15 and qualifying items include:

- Water heaters

- Home heating systems

- Smart Themostats

- Weatherization (and Low Income weatherization)

The online forms allow you to register and receive these rebates with proof of purchase.

Entergy Programs

The Arkansas Entergy electrical provider offers point-of-sale cash back rebates at the rate of $3-$350 for residents and customers who perform any energy-efficient upgrades.16

Energy-efficient upgrades apply to products like solar heat pumps and even LED light bulbs.

You can enroll in these programs for:

- Recycling old appliances ($25 per pick up)

- Installing energy efficient appliances

- Thermostat Controls

- AC Control

First Electrical Cooperative Loan Program

Again, customers of this company can smile all the way to the bank because they are lucky to have low annual percentage rate loans that can add up to $500-$15,000, provided that they install energy-efficient systems in their homes.

First Electric also offers net metering for solar home installations and a number of energy efficiency programs.17

How Can I Apply for Solar Tax Credits in Arkansas?

Now that you understand exactly what the solar tax credit is and how it is supposed to work, there is just one more thing: claiming solar tax breaks.

You have got to be very careful with this because the last thing you want is to miss out on the deal only because you overlooked something when filling out the solar credit form.

Before getting down to the procedure, you should know that the application is only done when you have already fully completed the project installation, not before.

The initial step is quite simple when you are already done with the installation process and now want to file your taxes. So, what forms do I need for solar tax credit?

- You will print out the IRS form 5695,11 which is literally the only way that the authorities will review your application.

- Fill out the document according to the IRS form 5695 instructions, detailing everything pertaining to the installation, from the size of the setup to how much money you spent to get it up and running.

- Enter the information on your 1040 form and file your taxes normally.13

If you get stuck on any part of answering the solar tax credit forms in Arkansas or are unsure about the details, you can always get the information from the installation company.

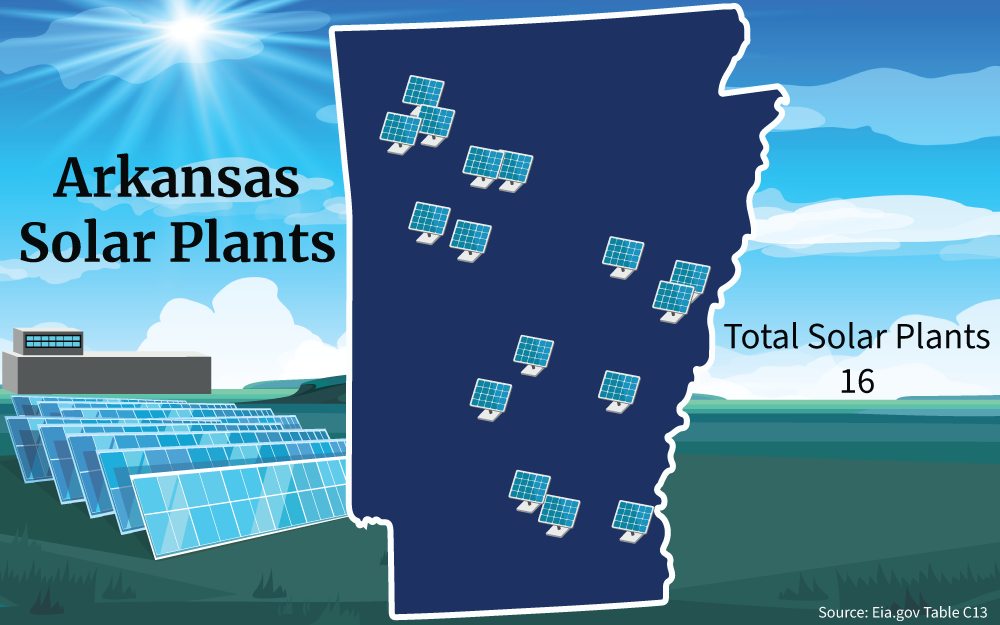

How Can I Sell Power to Arkansas? Current Solar Farms

Many people wonder, can you store solar energy?7 Of course you can and it is actually a go-to for many homeowners because they can be fully independent of the grid, manufacturing and using their own power from panels all through the year.

With a battery system installed, even cloudy days are no problem. By buying a backup for your photovoltaic solar cells, you will be able to power up your home all through the day and night, even when there are issues with the weather.

But what if you don’t have a backup, or what if you want to still draw power from the grid? Here is where net metering comes in.

It is a system designed to allow you as a solar panel owner to “sell” power to nearby utility companies in exchange for credits that you can also use to offset or reduce your electricity bills.

In order to make use of net metering, you will be glad to know that it is actually a breeze. As long as your system is at least 25 kW,1 you only have to ask your installation company to connect you to the grid, but before this, you will have to check whether your utility company has allowed for a bidirectional system in the meter.

The only issue that many homeowners have is the fact that the NEM policies are sort of declining in Arkansas and that the rates given are not in full as in other states.

And, it is even made worse by the fact that there are currently no strong RPS goals to improve the rates. That kind of explains why the residents would rather avoid the upfront average solar panel cost and instead choose to sign a Power Purchase Agreement (PPA) where the panels are installed at a low cost or are kind of like free solar panels in Arkansas, but you have to pay a certain amount at the end of the month.

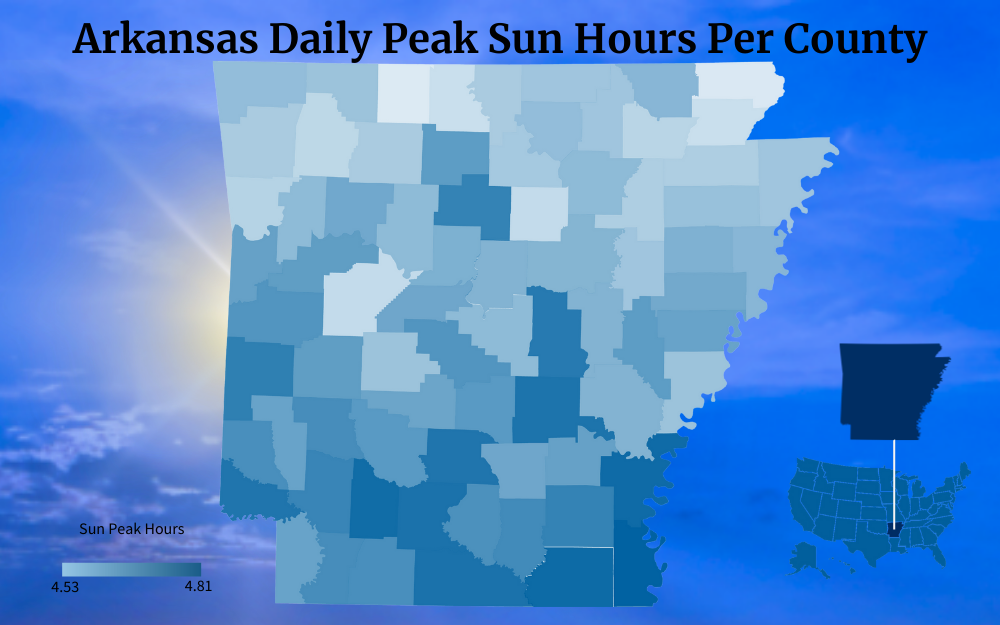

Installing Solar in Arkansas: Daily Peak Sunlight Hours

With an average of 217 sunny days, Arkansas has already positioned itself as an excellent place to go solar, because the national average stands at around 205.

You know that exposure to sunlight will be the least of your worries when you set up a home solar system, so why is the state still at number 30 when it comes to the solar power rankings?

Being the 12th sunniest state makes the solar Arkansas market boom more than it already is, but as you are yet to find out, there is more to it than just that.

Arkansas government solar incentives have proven to have a huge influence on the state of solar in any state, and unfortunately, there is more to be done in regard to solar programs that are present in the Land of Opportunity. This renewable energy makes up only 1.54% of the total power generation of the state; therefore, there is still a long way to go.5

You ca also use a residential solar panel calculator to figure your energy needs and the size of the solar system you’ll need.

But hold on, it is still looking pretty good for the state because of the solar tax credit that is available, which helps lower the cost of purchasing solar panels. The rate of adoption of the energy is predicted to rise by as much as 3,400 MW, that is, in the next five years or so, meaning that it is still something that is worth considering.

All that you need is to know the cost of solar panels in Arkansas, the tax credits available and how you can use them to get a great deal on your project.

Current Solar Power Costs and Materials

According to the energy profile of Arkansas, solar power is steadily on the rise, but you have to play your part, knowing the type of materials you need for a fully functional solar system.10

Apart from the panels that harness the power from the sun, you are also going to need:

- Inverters to convert the DC to usable AC

- Charge controller to regulate the amount of power coming in

- Battery system to store the excess electricity

One more thing when considering solar panel for home is how much are solar panels in Arkansas.

You have to bear that in mind because you have to find a way to finance the project, either using your savings, loans, or other methods. You have to know what you are getting into before ever considering it.

So, how much will it cost when installing solar panels in Arkansas?

Buying solar power cells in Arkansas, and other related equipment for that matter basically depends on the individual energy needs. The more power you need, the bigger the project will be, and of course, the more expensive the installation.

To put it more in perspective, if you are going for an 8 kW setup, the average solar panels cost is around $20,300, but on the other hand, if your installation has to be bigger than that, say 11 kW, you will end up spending upwards of $27,900.

What matters when you are going solar is actually the size of your house, the energy usage over the course of a single month and, of course, whether or not you make use of the available solar tax credits.

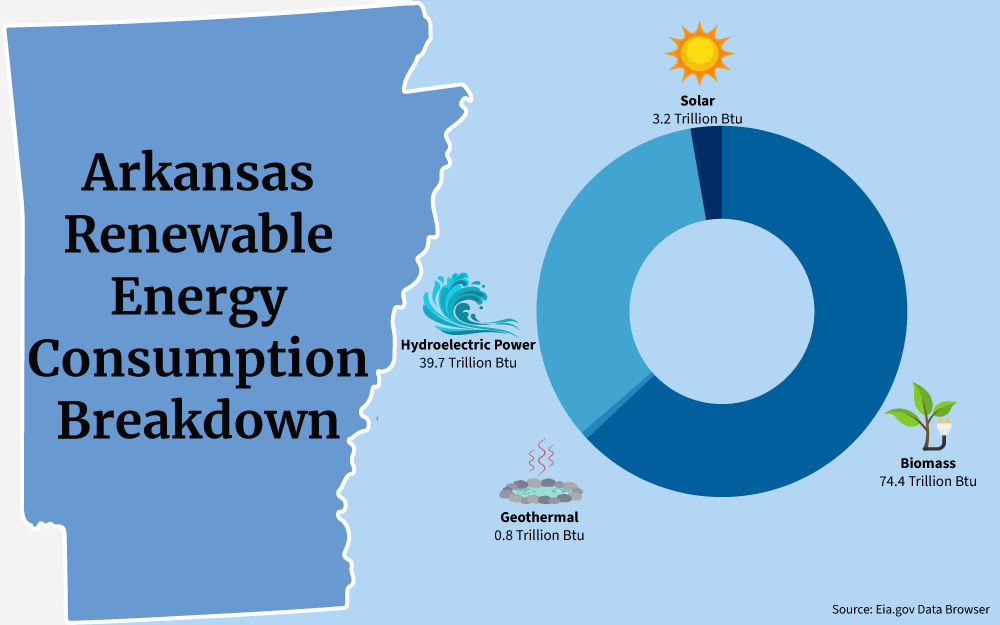

Any amount will help increase Arkansas’s renewable energy consumption, because currently, only a very small percentage of this is solar panels. Renewable energy comes in a number of forms, often called green power, but solar is one that is easily implemented in a residential setting.

Always note that the rate cannot be the same for two people because the choice of installer also matters.

- Brand name

- Quality of their products

- How they price everything

Solar Panel Calculator: Requirements and Cost Savings

If you are thinking about buying solar panels for the very first time, you will actually find online software like the NREL solar calculator very valuable.

First and foremost, you know that panels can be pretty costly, so knowing how many you actually need based on your needs really matters. The more your energy needs, the more panels you will have to buy and, obviously, the more expensive the installation will be.

So, how does the solar panel watts calculator or solar panels output calculator work?

Basically, what the online tools do to determine the wattage that comes from a solar panel is take the voltage of the system multiplied by the amperage and the total number of panels that are used.

Note that a typical solar panel is able to hold about 40-480 Watts. Say you want to determine exactly how many panels you will need for your project, you will have to take the size of the system and divide it by the size of a single panel.3

Did you know that there are also ways to find out exactly how much your solar panels will be able to save you when it comes to your utility bills? This gives you quite an insight when deciding to convert to solar for good.6

So, how does that work? Very simple, really, just take the total amount that would have been spent on utility bills over the lifespan of your panels, and subtract that from the cost of the panels; the difference is the total amount of savings you can earn.

Contractor Requirements for Home Solar System Installation

Knowing the requirements that ensure a great solar installation contractor can help make the process easier.

Most importantly, you want to go for a company that is well-versed with the solar panel regulations and one that you are certain will get the job done perfectly, in accordance with Arkansas solar incentives.

You can start by seeking recommendations from your friends and families; your best bet would be people who have already successfully installed the system because at least you will have an idea of what to expect from the installer.

Also ask if you can store solar energy with the system you plant to install.

Are Solar Panels Worth It in Arkansas?

Even with rebates and tax credits, solar energy system installation will cost a pretty penny.9

But, solar power is and will always be something worth considering and there are several factors to back that up.

For one, take a look at the solar panels savings that you will be expecting. As long as the panels have paid themselves off, which is usually in 10 years or so, you will be receiving power at absolutely no cost.

Imagine how much money you will be saving that would have gone to paying utility bills. That is probably one of the main reasons why so many people are making the switch to solar power because it is cheaper.

You can also imagine being fully independent of the grid system, that you can avoid obtaining energy from harmful fossil fuels and focus on a cleaner source.

How Does the Solar Tax Credit Work if I Don’t Owe Taxes?

Are you in the bracket of people who don’t pay taxes? Or you don’t have a tax liability in the current year of application?

Then, unfortunately, the solar tax credit will not be available for you. Just by the nature of the entire system, the ITC is meant to help you save by deducting the money from the amount of taxes that you owe, and if that is not available, then there is no way that it will work.

Can I Qualify for the Tax Credit if Someone Else Installed and Used the PV System?

The tax credit was created in order to encourage more and more people to embrace solar power. Now imagine using someone else’s system and posing it as yours; that would beat the whole purpose of the incentive, right?

The only way to get the ITC is if you are able to prove that you own the panels. They should be brand new installations and only belong to you, no one else’s.

That is why leased or PPA solar panels are automatically not eligible for the tax credit.

What if My Home Is Also a Business Location, How Does the Tax Credit Work?

The federal solar tax credit was created for both residential and business properties.8 What that means is that you will be able to apply for it for your home and your business, and if your business happens to be in the same place as your business, then the same rate will apply, and you will still get the 30% tax credit on the property.

You may ask, are solar panels bad for the environment? In comparison to other fuel sources, solar power has way lower emissions.

As long as the old panels are properly recycled, there is no need to worry about any negative effect on the environment.

Converting to solar power in Arkansas is one of the best decisions that a homeowner can make because it can lower your energy costs and help the planet as well.

Understanding the various Arkansas solar incentives available and how to take advantage of free enrollment now is the first step to energy independence.

Frequently Asked Questions About Arkansas Solar Incentives

How Much Do Solar Panels Cost in Arkansas?

The cost of Arkansas solar panels varies due to several factors and it all depends on the energy needs, the type of equipment you buy and how efficient they actually are. However, the average cost for installing solar panels is something like $20,300 for an 8 kW system.

Is There a Statewide Solar Tax Credit in Arkansas?

As much as it would really bump Arkansas up the list of the best states to go solar, the state government still doesn’t offer a specific solar tax credit for its residents at the moment. You will have to make do with the federal solar tax credit at least until there are more incentives introduced in the state.

What Are the Most Lucrative Solar Incentives in Arkansas?

Arkansans are able to enjoy the federal solar tax credit that stands at 30% off their total installation cost, but apart from that, they can also make use of net metering and other local rebate and loan programs that are being offered by various utility companies to get maximum savings and returns for going solar.

References

1Foushee, F. (2023, April 20). The Cost of Going Solar in Arkansas: What to Know. CNET. Retrieved August 24, 2023, from <https://www.cnet.com/home/energy-and-utilities/Arkansas-solar-panels/>

2Kulagin, C. (2023, June 8). The Complete List of Arkansas Solar Incentives [ Updated 2023 ]. EcoGen America. Retrieved August 24, 2023, from <https://ecogenamerica.com/Arkansas-solar-incentives/>

3Raman, M., & Darcy, M. (2023, June 5). Solar Panel Calculator. Omni Calculator. Retrieved August 24, 2023, from <https://www.omnicalculator.com/ecology/solar-panel#how-many-solar-panels-do-i-need>

4Simms, D. (2023, August 5). 2023 Arkansas Solar Tax Credits, Rebates & Other Incentives. EcoWatch. Retrieved August 24, 2023, from <https://www.ecowatch.com/solar/incentives/ar>

5Smith, J. (2023, July 6). Arkansas Solar Incentives: Tax Credits & Rebates 2023. SaveOnEnergy.com. Retrieved August 24, 2023, from <https://www.saveonenergy.com/solar-energy/Arkansas/>

6National Renewable Energy Laboratory. (2009, January). Own Your Power: A Consumer Guide to Solar Electricity for the Home. Retrieved August 31, 2023, from <https://www.nrel.gov/docs/fy09osti/43844.pdf>

7Solar Energy Technologies Office. (2023). Solar Integration: Solar Energy and Storage Basics. Office Of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/solar-integration-solar-energy-and-storage-basics>

8Solar Energy Technologies Office. (2023, August). Federal Solar Tax Credits for Businesses. Office Of Energy Efficiency & Renewable Energy. Retrieved August 31, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

9U.S. Energy Information Administration. (2021, July 16). Average U.S. construction costs for solar generation continued to fall in 2019. U.S. Energy Information Administration. Retrieved August 31, 2023, from <https://www.eia.gov/todayinenergy/detail.php?id=48736>

10U.S. Energy Information Administration. (2023, May 18). Arkansas Profile Analysis. U.S. Energy Information Administration. Retrieved August 31, 2023, from <https://www.eia.gov/state/analysis.php?sid=AR>

11U.S. Internal Revenue Service. (2022, December 6). Residential Energy Credits [PDF File]. IRS. Retrieved August 31, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

12U.S. Energy Information Administration. (2022, November 3). Average U.S. construction costs drop for solar, rise for wind and natural gas generators. [Graph]. EIA. Retrieved August 31, 2023, from <https://www.eia.gov/todayinenergy/detail.php?id=54519>

13Internal Revenue Service. (2023). Form 1040 (2022). IRS. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>

14North Arkansas Electric Cooperative Inc. (2023). Consumer Loan Application. North Arkansas Electric Cooperative Inc. Retrieved September 13, 2023, from <https://www.naeci.com/credit-application>

15Summit Utilities, Inc. (2023). Rebates: How it works. Arkansas Oklahoma Gas. Retrieved September 13, 2023, from <https://www.aogc.com/ResidentialRebates>

16Entergy Corporation. (2023). Residential solutions. Entergy Arkansas LCC. Retrieved September 13, 2023, from <https://www.entergy-arkansas.com/your_home/save_money/ee/residential-solutions/>

17First Electric Cooperative Corporation. (2023). First Electric Cooperative dedicates one-megawatt solar field in Benton. First Electric Cooperative Corporation. Retrieved September 13, 2023, from <https://www.firstelectric.coop/solar>

18Screenshot from Internal Revenue Service. IRS. Retrieved from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>